- Download the app for iPhone or Android

- Create a Cash App account

- Connect Cash App to your Dollar Bank account using your account and routing numbers

- To locate your account and routing numbers, log in to Online Banking, click your account and then click Details. You will see your Routing Number displayed, and can then click Show Full Account Number.

P2P Payments

Information on Zelle®, Cash App, PayPal and Venmo below.

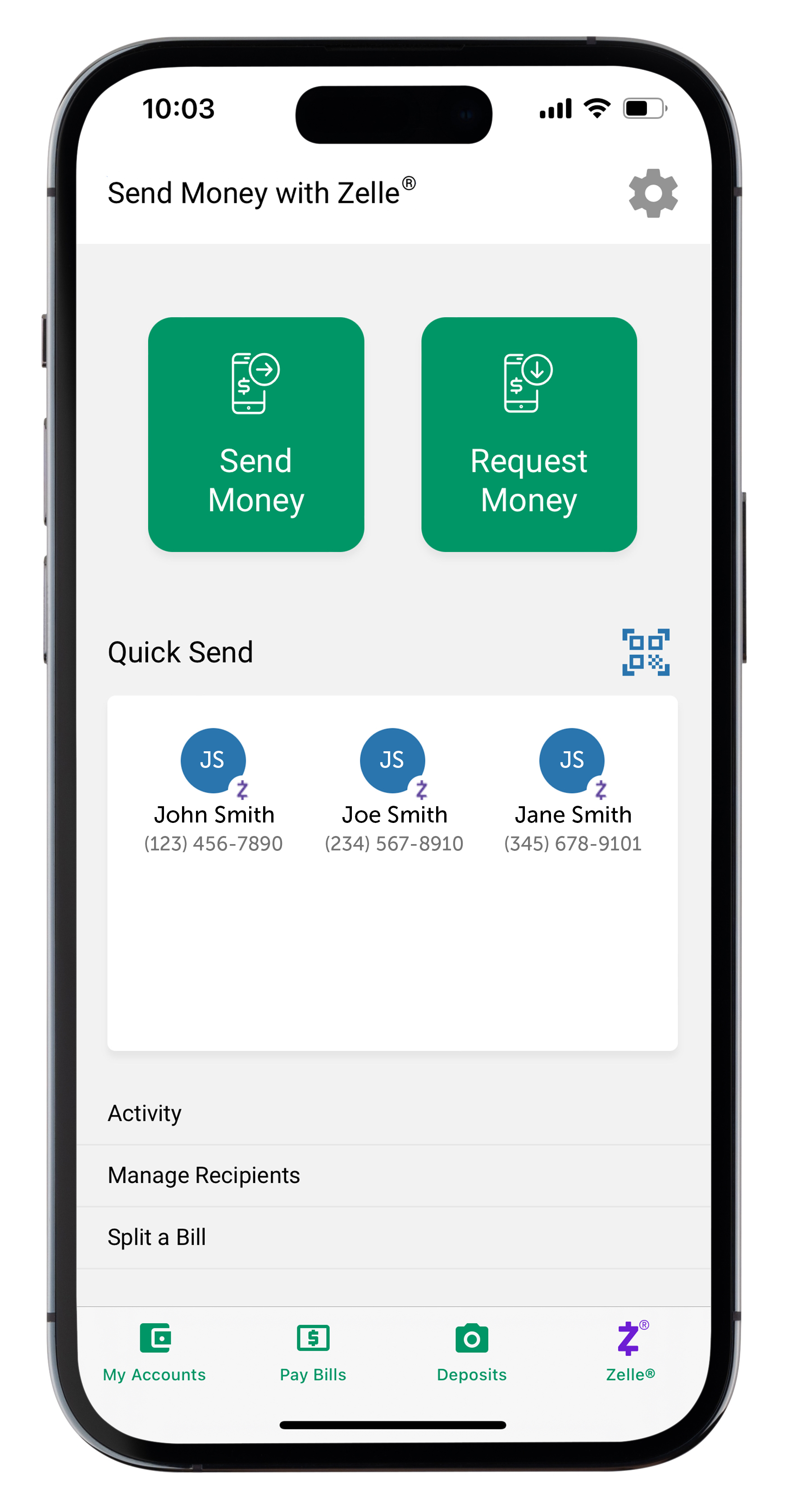

Using Zelle® for P2P (peer-to-peer) Payments

Zelle® is available in over 2,200 banks and credit unions of all sizes, enabling consumers and many small businesses to send digital payments to people and businesses they know and trust with an eligible bank account in the U.S. And it's available in the Dollar Bank Mobile App and Online Banking.

Here's how to get started with Zelle®

- Log in to Online Banking or the mobile app and click Send Money with Zelle® to enroll

- Enter the email address or U.S. mobile number of the person you want to pay, then enter the payment amount and send

- If your recipient is already enrolled with Zelle®, the money will go into their bank account, typically in minutes*

- If they aren’t enrolled yet, they’ll receive a notification letting them know how to enroll to receive their money

Using Other P2P (peer-to-peer) Payment Apps

Below are instructions on how to link some of the other most common P2P options with your Dollar Bank Account.

How to get started with PayPal:

- Go to paypal.com to create your account or download the app for your Android or iPhone

- Choose an account type and click Get Started

- Enter your email address and click Next

- Enter your personal or business details and create a password

- Follow the on-screen instructions to connect your Dollar Bank account

- Download the mobile app for your iPhone or Android

- Open the mobile app

- Create your username and a secure password

- Verify your phone number and email address

- Connect and verify your Dollar Bank account

To send payments on Venmo directly from your Dollar Bank account, you’ll first need to verify that account.

Manual Verification (with microtransfers)

When you add your Dollar Bank account to Venmo manually (using your routing and account number), Venmo will send two small deposits and two withdrawals to your bank account to verify ownership (these will be less than $1 each). These "microtransfer" amounts should offset each other, so there is no net change to your account balance.** To avoid any overdraft fees, make sure you have at least $2 in your account.

You should see these deposits/debits in your Dollar Bank account within 1-3 business days as separate items on your bank statement. Once you do, you can return to the Venmo app and follow these steps:

1. Go to the Me tab

2. In the Wallet section, tap on the bank you want to verify (it should say “Unconfirmed”)

3. Tap Verify and enter the microtransfer amounts in the two Amount fields

4. Tap Verify again to finish the process

While P2P payment services are easy to set up and use, it’s important to be aware that scammers may try to trick you into sending money.

Here are some tips to help you avoid payment scams:

- Don't share bank authentication or verification numbers or your personal information with anyone who contacts you requesting it

- Set up alerts to notify you of any transaction on your account

- Only send money to people you know

Questions?

Members of the Dollar Bank Blue Crew can help you link your Dollar Bank account with your P2P payment app, along with answering other common Online Banking questions.

*To send or receive money with Zelle®, both parties must have an eligible checking or savings account. Transactions between enrolled users typically occur in minutes. Select transactions could take up to 3 days.

**If you are signed up to receive text alerts about transactions, text, data and phone charges from your provider may apply.

Venmo is a registered trademark of PayPal, Inc.

Cash App is a registered trademark of Block, Inc.