Home Equity Rates

Dollar Bank has some of the lowest rates and fees around for home equity loans and home equity lines of credit. Take a look below! We have other rates and terms available - contact one of our loan experts, visit an office or loan center near you, or call 1-800-242-BANK for more information.

The monthly payments shown below do not include costs for taxes and insurance. Your actual monthly payment obligation will be greater.

Apply Now

Confused on whether a Home Equity Loan or Home Equity Line of Credit (HELOC) is the better loan for you? It depends on why you're borrowing.

If you need to make large, recurring payments such as for school or home improvements or want funds available in case of emergencies, a HELOC is a good option.

If you have a one-time borrowing need, such as debt consolidation or home improvements that require a substantial lump sum up front, a fixed-rate Home Equity Loan is the way to go.

Fixed Rate Home Equity Term Loans

Product | Term | Loan Amount | APR as Low as* | Monthly Payment |

|---|---|---|---|---|

Home Equity LoanNo closing costs | 84 120 144 180 | $75,000 $75,000 $100,000 $100,000 | 5.64% 5.79% 5.79% 5.84% 5.99% | $1,082.74 $824.77 $965.02 $835.24

|

Home Equity Loan | 84 144 180 | $50,000 $100,000 $150,000 | 5.89% 5.89% 5.94% | $727.79 $970.17 $1,260.93 |

Home Equity Loan | 60 96 | $25,000

| 5.99%

| $483.20

|

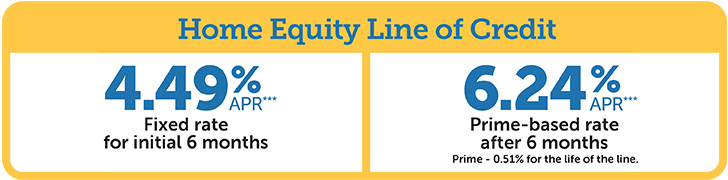

Variable Rate Home Equity Lines of Credit (HELOC)

Product | Loan Amount | APR as Low as* | Monthly Payment |

|---|---|---|---|

Home Equity Line of Credit (1st and 2nd Lien) | $50,000 $100,000 | 6.24% 5.99% | $400.00 $800.00 |

*The Annual Percentage Rates (APRs) shown are available to well qualified borrowers and include a .25% discount with any one of several qualifying checking accounts. The APRs are not available for the refinance of an existing Dollar Bank loan or mortgage, but Fixed Rate Term Loans and Variable Rate Home Equity Lines of Credit refinances may be eligible for the .25% discount with $15,000 or more of new money available or advanced. Qualifying checking accounts are subject to certain terms and conditions that may change after account opening. Rates are based on Home Equity Loans and Lines of Credit up to $500,000, one to four family owner-occupied property, loan-to-value (LTV) ratio of 80% or less, and a debt-to-income ratio of 45% or less. For real estate secured products, property insurance is required and flood insurance may be required. An appraisal ranging from $75 to $695 may be required. For loans secured by your home, closing costs typically range from $270 to $480 (up to $1,950 in VA and up to $3,775 in MD) and can vary depending upon property type, location, and loan. For variable Lines of Credit, APR is based on Prime Rate which may increase after account opening, and the $50 annual fee is waived in first year. Your actual APR will be determined by the amount of your loan, loan-to-value and lien position if applicable, repayment term, and a review of your credit. APRs are accurate when accessed and are subject to change without notice. For residents of Dollar Bank’s market areas only. Approval is subject to Dollar Bank underwriting guidelines.

**No closing costs on loan amounts up to $500,000. If your loan is prepaid in full within 36 months, you will reimburse Dollar Bank for third-party closing costs paid. The Annual Percentage Rate (APR) is available to well qualified borrowers with a loan-to-value (LTV) ratio of 80% or less and a debt-to-income ratio of 45% or less. APR includes a 1/4% discount with any one of several qualifying checking accounts and is not available for the refinance of an existing Dollar Bank loan, line, mortgage, or credit card. Qualifying checking accounts are subject to certain terms and conditions that may change after account opening. Available for one to four family owner-occupied property only. Home Equity Loan transaction must result in first lien mortgage and cannot be a purchase money mortgage. Payment does not include taxes and insurance premiums, the actual payment obligation will be greater. Your actual APR may be higher based on the amount of your loan, loan-to-value, lien position, repayment term, and review of your credit. Other rates and terms are available. Rate and offer subject to change without notice and cannot be combined with any other offer. Property insurance is required. Borrower is responsible for any recording-related taxes or fees in Maryland and Virginia. Offer does not apply to Home Works Home Loans.

***The Annual Percentage Rate (APR) shown is accurate as of 2/18/26 and is available to well qualified borrowers for line amounts of $50,000 to $500,000 and is subject to change without notice. APR includes a 1/4% discount with any one of several qualifying checking accounts and is not available for the refinance of an existing Dollar Bank loan, line, or mortgage unless the refinance includes $15,000 or more of new money available or advanced. Qualifying checking accounts are subject to certain terms and conditions that may change after account opening. Rate is fixed for the 6-month introductory period beginning from account opening. Afterward, rate is variable based on Prime and is for maximum ratios of 80% loan-to-value and 45% debt-to-income. Your actual APR may be higher based on the amount of your loan, loan-to-value, lien position, repayment term, and review of your credit. The maximum APR is equal to the Prime-based rate plus 10.00%. Available for first and second lien position and one to four family owner-occupied property only. Property insurance is required, flood insurance may be required. An appraisal may be required. If required, the appraisal fee will range from $75 - $695. The $50 annual fee will be waived in the first year. For residents of Dollar Bank’s market areas only. Approval is subject to Dollar Bank underwriting guidelines. Transfer limitations apply.

We're here to help 1-800-242-2265

Dollar Bank representatives are available Monday - Friday from 8:00 AM - 8:00 PM and Saturday from 9:00 AM - 3:00 PM.

Contact our loan experts