How Much Equity Do You Have in Your Home?

How Much Equity Do You Have in Your Home?

Owning a home is a life milestone for many, and it can be one of your biggest investments. Part of that investment, and a prime benefit of owning a home, is reflected in your home’s equity. Knowing how much equity you have in your home can help you when applying for a home equity loan, home equity line of credit or refinancing. The amount of equity in your home is a crucial factor in determining the maximum loan amount you may qualify for. So, the question is: how much equity do you have in your home?What is home equity?

Home equity is simply the difference between the current market value of your home and the balance of the mortgage or other liens attached to the home. To get a general idea of what your home is currently worth, look at the sold-for prices of similar homes in your neighborhood for a comparable estimate. Recent tax assessments may also list your home’s market value.

For example: If your home is valued at $250,000 and you owe $175,000 on your mortgage, you would have $75,000 of equity in your home.

How home equity works and why it matters

Your home’s equity won’t remain fixed. It changes due to your home’s current market value and your mortgage payments. As you pay off your mortgage, the equity in your home typically rises. If the current market value of your home declines at a rate faster than you’re paying off your mortgage, your home’s equity can drop. On the flip side, if housing prices in your area increase that can boost your home’s equity. This is why it’s so important to know what your home is worth and what your equity in it is.

There are a variety of ways you can use your home’s equity to your benefit with a home equity loan. Home equity loans can be used for home improvement projects like an addition or remodel, large expenses, debt consolidation and more.

How to calculate your home’s equity

There are two numbers that you will need to estimate the equity in your home. First is the approximate current market value of your home. As mentioned, you can use a recent tax assessment or the sale price of a similar home that has sold recently in your neighborhood to estimate your equity, or you can hire a real estate appraiser for an official valuation of the home’s current market value. Second, you will need to know the current remaining balance on your existing mortgage.

With your home’s current value and your mortgage balance in hand, you are now ready to determine the equity available to secure a loan.

The formula for calculating your home equity is simple.

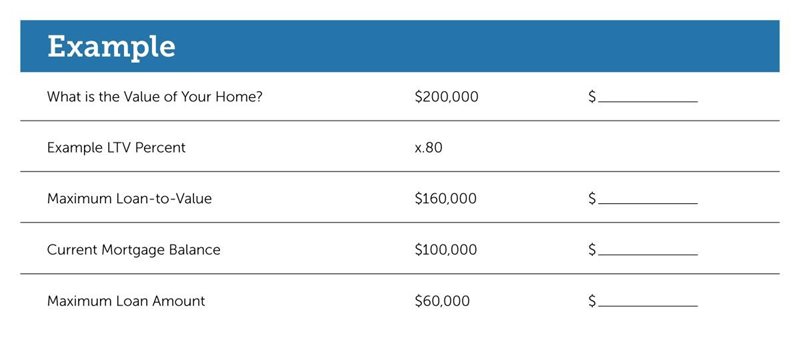

While your available equity in this example is $100,000, in order to reduce risk of losses most banks establish a maximum loan-to-value ratio, or LTV, when determining the maximum loan amount you qualify for. This compares the loan amount with the current value of the home to determine how much the bank can lend you with minimal risk. A home equity calculation uses your existing mortgage balance as part of the equation, but note that any other loans (i.e. 2nd lien) or lines of credit secured by the home need to be part of that balance as well.

Refinancing is another option to consider when looking at home equity loans.

Instead of only taking out a home equity loan separate from your mortgage, you can refinance with a $160,000 home equity loan, pay off your current $100,000 mortgage balance and have $60,000 available for home improvement projects. Deciding whether to refinance depends on your situation and the house you settle on, but the option gives you wiggle room in how you get to your final “dream home.”

Want to check your work? Try our home equity calculator.

Tips on boosting the equity in your home

Despite how a home’s value or equity may change over time, there is plenty you can do to manage your equity in a positive direction. Here are a few tips for boosting your home equity:

- Keep up with your mortgage payments or increase your payment amount: Your mortgage payments are split between the principal balance and interest, and paying above the minimum amount allows you to gradually increase how quickly the principal balance is paid off.

- Give your home at least five years: Since the housing market is always changing, your home’s value changes as well. By staying in your home for five or more years, you’ll have a greater chance of seeing its value go up, increasing the home’s equity.

- Perform renovations or work on your home’s curb appeal: By making additions, renovations, or other changes to the home and property, you’ll be able to increase your home’s value, along with the equity in it.

If you have any questions about figuring out your home’s equity, or would like to know more about how a home equity loan can help you, contact our loan experts. We are here to help!

This article is for general information purposes only and is not intended to provide legal, tax, accounting or financial advice. Any reliance on the information herein is solely and exclusively at your own risk and you are urged to do your own independent research. To the extent information herein references an outside resource or Internet site, Dollar Bank is not responsible for information, products or services obtained from outside sources and Dollar Bank will not be liable for any damages that may result from your access to outside resources. As always, please consult your own counsel, accountant, or other advisor regarding your specific situation.

Posted: June 11, 2021