Loan Sale is Back: Now through March 31

All loans. All terms. All on sale.

Whether you're dreaming of a home renovation, an unforgettable wedding or a simplified monthly budget, it's the perfect time to borrow. Take advantage of our competitive rates and flexible terms on financing solutions tailored to fit your needs.

Schedule an appointment or stop by one of our convenient offices to explore your options. Hurry our Loan Sale is a limited-time event!

We have the perfect loan for your needs.

Outdated kitchen or leaking roof? Tap into your home's equity to lock in a great rate on a loan.

Streamline your budget, lower your monthly payments and put more money in your pocket.

Looking to finance a college education, a dream wedding or make another major purchase? We'll tailor a loan to fit your life.

Sometimes the unexpected happens, but we’re here to help you borrow what you need.

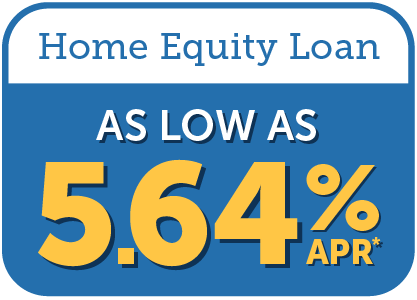

Home Equity Loan

Tap into your home equity to take advantage of lower loan rates.

If you have a one-time borrowing need that requires a substantial lump sum payment upfront, such as a home improvement project or debt consolidation, a home equity loan may be a beneficial financing option. With a home equity loan, you’ll lock in a fixed interest rate and payment for the life of your loan - and enjoy easy budgeting.

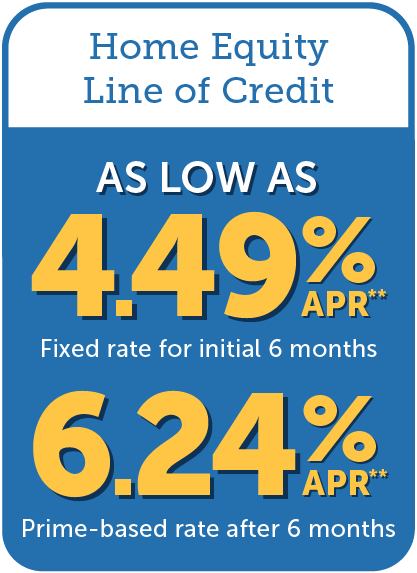

Home Equity Line of Credit (HELOC)

Borrow what you need, when you need it!

You can also leverage the equity in your home with a HELOC. A line of credit is a variable rate, open-ended loan that gives you the flexibility to borrow again and again, up to your limit, without having to reapply. And you only make payments on the amount you use.

A HELOC is a beneficial option if you want to have funds available in case of an emergency, such as repairing your roof or car, or paying other unexpected bills. Plus, with a variable interest rate, you could save money if interest rates go down.

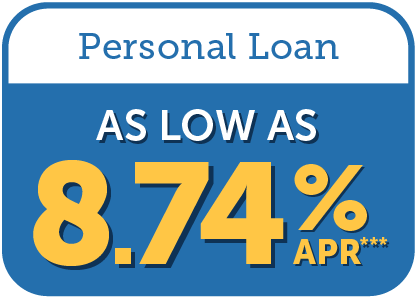

Personal Loan

No home equity to tap into? We've still got you covered.

Personal loans are unsecured loans that can be helpful for small home improvements, debt consolidation, unexpected expenses and more. Our Personal Term Loan has a fixed rate and a fixed monthly payment for the entire term of the loan, which means easy budgeting and protection against rate fluctuations for you.

Our loan experts are here to customize a solution for you.

They don't take sales commissions, which means their sole purpose is finding the best loan for you, not the bank. Chat with a loan expert today to learn about your borrowing options. Here's some information to have handy:

- Information about your existing loans

- Your estimated monthly income and expenses

- Employment information

- The estimated value of your home

- Property tax information

- Homeowners insurance information

Want us to contact you instead? Let's get started.

Simply complete the form below and a loan expert from your area will help you develop a solution for your needs.

* No closing costs for loan amounts up to $500,000. If your loan is prepaid in full within 36 months, you will reimburse Dollar Bank for third-party closing costs paid. The Annual Percentage Rate (APR) shown is accurate as of 2/23/26 and is available to well qualified borrowers for a loan amount of $75,000, a term of 84 months, a loan-to-value (LTV) ratio of 80% or less, and a debt-to-income ratio of 45% or less. APR includes a 1/4% discount with any one of several qualifying checking accounts and is not available for the refinance of an existing Dollar Bank loan, line, mortgage, or credit card. Qualifying checking accounts are subject to certain terms and conditions that may change after account opening. Available for one to four family owner-occupied property only. Home Equity Loan transaction must result in first lien mortgage and cannot be a purchase money mortgage. The monthly payment per $1,000 borrowed at 5.64% APR is $14.44 for 7 years. Payment does not include taxes and insurance premiums, the actual payment obligation will be greater. Your actual APR may be higher based on the amount of your loan, loan-to-value, lien position, repayment term, and review of your credit. Other rates and terms are available. Rate and offer subject to change without notice and cannot be combined with any other offer. Property insurance is required. Borrower is responsible for any recording-related taxes or fees in Maryland and Virginia. Offer does not apply to Home Works Home Loans. For residents of Dollar Bank’s market areas only. Approval is subject to Dollar Bank underwriting guidelines.

** The Annual Percentage Rate (APR) shown is accurate as of 2/18/26 and is available to well qualified borrowers for line amounts of $50,000 to $500,000 and is subject to change without notice. APR includes a 1/4% discount with any one of several qualifying checking accounts and is not available for the refinance of an existing Dollar Bank loan, line, or mortgage unless the refinance includes $15,000 or more of new money available or advanced. Qualifying checking accounts are subject to certain terms and conditions that may change after account opening. Rate is fixed for the 6-month introductory period beginning from account opening. Afterward, rate is variable based on Prime and is for maximum ratios of 80% loan-to-value and 45% debt-to-income. Your actual APR may be higher based on the amount of your loan, loan-to-value, lien position, repayment term, and review of your credit. The maximum APR is equal to the Prime-based rate plus 10.00%. Available for first and second lien position and one to four family owner-occupied property only. Property insurance is required, flood insurance may be required. An appraisal may be required. If required, the appraisal fee will range from $75 - $695. The $50 annual fee will be waived in the first year. For residents of Dollar Bank’s market areas only. Approval is subject to Dollar Bank underwriting guidelines.

*** The Annual Percentage Rate (APR) shown is accurate as of 2/23/26 and is available to well qualified borrowers for an unsecured loan in the amount of $15,000 and a term of 60 months. APR includes a 1/4% discount with any one of several qualifying checking accounts and is not available for the refinance of an existing Dollar Bank loan, line, or mortgage. Qualifying checking accounts are subject to certain terms and conditions that may change after account opening. The monthly payment per $1,000 borrowed at 8.74% APR is $20.63 for 5 years. Your actual APR may be higher based on the amount of your loan, repayment term, and review of your credit. Rate and offer subject to change without notice. For residents of Dollar Bank’s market areas only. Approval is subject to Dollar Bank underwriting guidelines.